Maximizing Healthcare Protection With Medicare Advantage Insurance Policy

As the landscape of medical care remains to evolve, people looking for comprehensive protection commonly transform to Medicare Benefit insurance policy for an extra comprehensive strategy to their medical needs. The attraction of Medicare Advantage hinges on its possible to use a more comprehensive variety of solutions beyond what conventional Medicare strategies give. By discovering the benefits of this alternative, understanding enrollment procedures, and discovering cost-saving strategies, people can open a world of health care opportunities that satisfy their one-of-a-kind demands. But just what does optimizing healthcare protection with Medicare Benefit require? Let's explore the details of this insurance choice to reveal how it can be maximized for your health care journey.

Benefits of Medicare Advantage

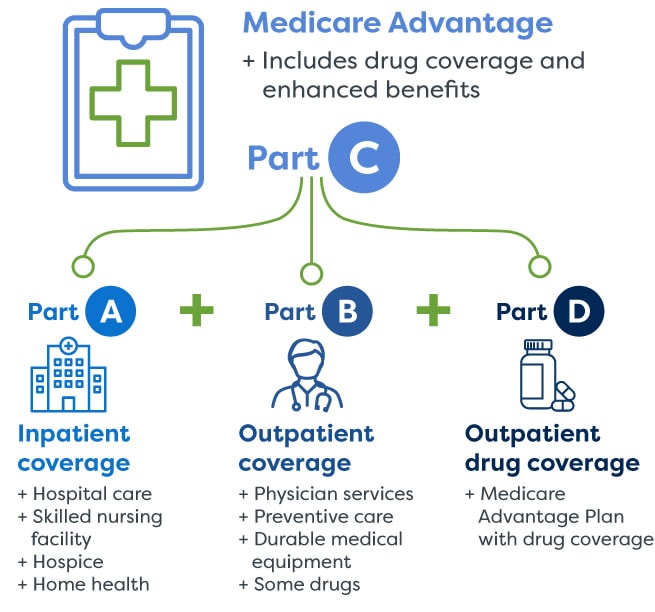

What advantages does Medicare Benefit offer over standard Medicare plans? Medicare Advantage intends, also referred to as Medicare Part C, give numerous benefits that establish them in addition to traditional Medicare strategies. One essential advantage is that Medicare Advantage plans commonly include additional coverage not offered by original Medicare, such as vision, oral, hearing, and prescription medication coverage. This comprehensive protection can assist recipients conserve cash on out-of-pocket expenses for solutions that are not covered by conventional Medicare.

Additionally, Medicare Benefit intends normally have out-of-pocket maximums, which restrict the quantity of money a beneficiary needs to spend on protected solutions in a given year. This monetary security can provide satisfaction and assistance individuals spending plan for medical care prices better (Medicare advantage plans near me). Furthermore, lots of Medicare Advantage plans deal health care and various other preventive services that can help recipients stay healthy and handle chronic problems

Registration and Eligibility Requirements

Medicare Advantage strategies have details enrollment requirements and qualification requirements that individuals should fulfill to sign up in these extensive health care insurance coverage options. To be qualified for Medicare Advantage, individuals should be signed up in Medicare Part A and Component B, additionally known as Original Medicare. Additionally, most Medicare Advantage prepares call for candidates to live within the plan's solution location and not have end-stage kidney illness (ESRD) at the time of registration, though there are some exceptions for individuals currently enrolled in an Unique Requirements Plan (SNP) tailored for ESRD patients.

Cost-saving Opportunities

After guaranteeing qualification and registering in a Medicare Advantage strategy, individuals can check out different cost-saving possibilities to optimize their medical care insurance coverage. One significant means to conserve expenses with Medicare Advantage is through the plan's out-of-pocket optimum limit. As Visit Website soon as this limitation is reached, the plan generally covers all extra accepted clinical costs for visit this website the remainder of the year, giving monetary relief to the beneficiary.

Another cost-saving opportunity is to make use of in-network health care providers. Medicare Advantage intends often bargain affordable rates with particular physicians, healthcare facilities, and pharmacies. By staying within the plan's network, individuals can take advantage of these reduced prices, ultimately reducing their out-of-pocket expenditures.

Moreover, some Medicare Advantage plans offer extra advantages such as vision, oral, hearing, and health programs, which can aid people conserve cash on solutions that Original Medicare does not cover. Making the most of these additional advantages can bring about considerable cost savings over time.

Additional Insurance Coverage Options

Checking out additional healthcare benefits beyond the basic protection supplied by Medicare Benefit strategies can boost overall wellness and health outcomes for beneficiaries. These additional coverage choices frequently include solutions such as oral, vision, hearing, and prescription medicine insurance coverage, which are not usually covered by Original Medicare. By availing these supplementary benefits, Medicare Benefit beneficiaries can deal with a wider variety of medical care demands, leading to improved quality of life and better wellness administration.

Dental insurance coverage under Medicare Advantage plans can consist of routine exams, cleansings, and also major dental treatments like root canals or dentures. Vision benefits may cover eye examinations, glasses, or get in touch with lenses, while hearing insurance coverage can aid with listening device and related services. Prescription medication protection, additionally referred to as Medicare Component D, is crucial for taking care of medicine costs.

In Addition, some Medicare Advantage plans offer extra advantages such as fitness center subscriptions, telehealth solutions, transport assistance, and non-prescription allowances. These additional benefits contribute to a much more comprehensive medical care strategy, promoting precautionary care and timely interventions to sustain recipients' wellness and wellness.

Tips for Maximizing Your Plan

How can recipients make one of the most out of their Medicare Benefit strategy protection while making the most of healthcare benefits? Right here are some vital pointers to help you optimize your plan:

Understand Your Coverage: Make the effort to assess your plan's advantages, including what is covered, any type of constraints or constraints, and any kind of out-of-pocket costs you may sustain. Recognizing your protection can aid you make informed medical care choices.

Make The Most Of Preventive Services: Numerous Medicare Benefit plans deal protection for preventive services like testings, inoculations, and wellness programs at no additional price - Medicare advantage plans near me. By remaining up to date on preventative treatment, you can assist maintain your health and potentially stop more major health and wellness issues

Testimonial Your Drugs: Make certain your prescription drugs are covered by your plan and explore chances to minimize expenses, such as mail-order pharmacies or generic alternatives.

Final Thought

In conclusion, Medicare Benefit insurance coverage offers numerous benefits, cost-saving opportunities, and extra protection choices for eligible people. By maximizing your plan and taking advantage of these advantages, you can ensure thorough medical care protection.